Ted Kennedy Jr.

Co-Chair at Disability Equality IndexTed Kennedy, Jr. is the Co-Chair of the Disability Equality Index (DEI), the leading corporate social responsibility, accountability and ESG benchmarking tool that scores and tracks businesses on their disability inclusion policies and practices. He is also a health care attorney and partner in the law firm Epstein Becker Green and a former State Senator.

As an amputee and childhood bone cancer survivor, Ted has been an active leader in the disability rights and independent living movements nearly his entire life. Since his appointment to the President’s Committee on Employment of People with Disabilities under President Ronald Reagan, to his role as immediate past Chair and current Member of the Board of the American Association of People with Disabilities (AAPD), Ted has fought to expand job opportunities and to advance the economic independence of people with disabilities. He knows that businesses can play a pivotal role in ensuring that people with disabilities have the same rights as everybody else, and how inclusion drives business success.

Ted believes that disability equality and inclusion is the next chapter of responsible capitalism and ESG investing, and he is spearheading the adoption of the Joint Investor Statement on Corporate Disability Inclusion. Signed by over 30 of the world’s largest institutional investors and financial services organizations, this shareholder engagement strategy represents a new, concerted effort in the disability rights movement, recognizing the unique role that companies play in the creation of a more just and equitable society.

At Epstein Becker Green, Ted advises many of the nation's foremost health care companies on the key legal, regulatory, reimbursement, coverage issues and emerging policy changes facing hospitals, post-acute providers, government and commercial insurance entities, and life sciences companies. From 2015 to 2019, Ted also served as a State Senator in the Connecticut General Assembly.

Maria Lettini

Chief Executive Officer at US Sustainable Investment ForumMaria is the Chief Executive Officer of the US Sustainable Investment Forum, the pioneering network focused on sustainable investing (RIAA's equivalent industry body in the United States). Maria joined the US Sustainable Investment Forum in May of 2023 and brought with her notable capital markets experience. She is an innovative leader within the field of sustainability and finance and is recognized for building meaningful partnerships across the value chain of global institutional investors, corporates, policymakers, multi-national organizations, and other related stakeholders to address some of the world’s most critical, and financially material, environmental and social challenges.

Most recently Maria led the FAIRR Initiative. During her six years at FAIRR, she and her team ambitiously drove the narrative around the risks and opportunities in the global protein supply chain with the aim of directing capital towards a more sustainable and equitable food system. Under her tenure, the FAIRR investor network grew to over $70 trillion in combined assets and FAIRR’s expert research on climate, biodiversity, anti-microbial resistance, and other risks, reframed the narrative on animal agriculture and sustainable protein.

Prior to joining FAIRR, Maria worked for the UN-supported Principles for Responsible Investment (PRI) where she cultivated and expanded the global investor network, managing the PRI’s Signatory Relations strategy and raising awareness of material ESG issues with institutional investors.

Maria started her career in global finance and capital markets, working at both J.P. Morgan and Deutsche Bank. She has served on the Sustainability Accounting Standard Board Standards Advisory Group. She is also a member of the Intentional Endowment Network’s (IEN) Steering Committee.

Maria is based in Washington DC but has lived and worked in San Francisco, New York, Madrid and London. She holds a MA (Distinction) in Environment, Politics and Globalization from King’s College London and a BA in International Business, Latin American Studies and Spanish from San Diego State University.

Kate O'Rourke

Commissioner at Australian Securities & Investments Commission (ASIC)Kate commenced as an ASIC Commissioner for a five-year term in September 2023.

She has more than 25 years’ experience in law and regulation across financial services, markets, and corporations.

Kate joined ASIC from Treasury, where she held senior leadership positions with responsibility for data and digital economic reforms, COVID economic policy responses, small business policy and regulatory frameworks governing market conduct.

Kate previously held senior executive roles at ASIC with responsibility for corporate transactions and governance, and practised in the Sydney and New York offices of the law firm Sullivan and Cromwell.

She holds Bachelor’s degrees in Economics (Social Science) and Law from the University of Sydney, a Master of Laws from the New York University School of Law, and an Executive Master of Public Administration from the University of New South Wales.

Tyson Yunkaporta

Senior Lecturer, Indigenous Knowledges at Deakin UniversityIndigenous skolar (Apalech clan (Wik) Lostmob Nungar) working with Indigenous Systems Knowledge and collective Indigenous inquiry methods inflected with complexity science to resolve global existential threats and issues in regenerative design responses to crises. Works across disciplines in literature/creative writing, sociology of religion (disinformation/conspirituality/IO's), history, Indigenous Knowledges, psychology, environmental studies, architecture/engineering/Indigenous design and technology. Founder of the Indigenous Knowledge Systems Lab. Author of Sand Talk: How Indigenous Thinking Can Save the World and Right Story, Wrong Story: Adventures in Indigenous Thinking.

Naomi Edwards FAICD

Chair and National Director of Australian Institute of Company Directors (AICD)Naomi has more than 20 years of board experience, including at ASX-listed companies, superannuation funds, government entities and not-for-profits. In 2023 she was President of the Actuaries Institute of Australia, and she was a director of the AICD board from 2018–22. Naomi is a Fellow of the Institute of Actuaries (Australia) and a former partner of Deloitte. Naomi has had an executive career in the life insurance industry and has also worked extensively with fund managers and superannuation funds, in the Industry Super, retail ESG and ethical super spaces. She currently works as a chair and non-executive director across a variety of listed and unlisted companies. Naomi is currently a non-executive director for TAL, Yarra Funds Management and Propel Funeral Partners. She is the former chair of Spirit Super, Accurium Pty Limited and Australian Ethical Investment. She has also served on the boards of Australian Ethical Super, the Australian Institute of Superannuation Trustees, the Tasmanian Development Board, Hunter Hall and Nikko AM Ltd.

David Atkin

Chief Executive Officer at Principles for Responsible Investment (PRI)David Atkin is the CEO of the Principles for Responsible Investment (PRI). The PRI is a UN-supported organisation, with more than 5,300 signatories who collectively represent over US $128 trillion in AUM. He is responsible for the PRI’s global operations.

David previously served as the Deputy CEO for AMP Capital and prior to that spent almost 13 years as the CEO for Cbus Superannuation Fund, where he saw membership grow from 500,000 to over 750,000 and AUM rise to AUD $55 billion.

David has received the Distinguished Alumni Award from La Trobe University for his work in the sustainable finance field, was awarded the Fund Executives Association Ltd (FEAL) Fund Executive of the Year in 2017 and was presented with an Association of Superannuation Funds of Australia (ASFA) Life Membership in 2020.

Ming Long AM

Non-Executive DirectorMing Long AM brings deep expertise in leading organisational transformation and navigating complex stakeholder landscapes through market disruption. She serves as Non-Executive Director of Telstra Corporation Limited, QBE Insurance (Auspac), IFM Investors, and as Deputy Chair of CSIRO. She shapes corporate governance and climate response through her roles on ASIC's Corporate Governance Consultative Committee and the AICDs Climate Governance Initiative Council.

Marco Lambertini

Convener at Nature Positive InitiativeMarco is Convenor of the Nature Positive Initiative, an international coalition of organisations that promotes the integrity and implementation of Nature Positive by 2030. He was previously WWF International Director General (2014-2022) and Special Envoy (2023). Before joining WWF he was Global Director of Network and Programme and subsequently CEO of BirdLife International.

Marco’s experience and career ranges from ecological field research to high level advocacy and international policy, nature reserve management, integrated conservation and development projects, environmental education, NGO development, communications and campaigning, in many countries all over the world.

Marco is a member of the China Council (CCICED), a member of the Board of Directors for the Fondation Prince Albert III de Monaco, co-chair of the Nature Action 100 Science Council, former co-chair and now Board member of the Belt and Road Initiative Greening Coalition, a founding member of the Nature Action Agenda and the Friends of Ocean Action at WEF, outgoing member of the UN Global Compact Board and former co-focal point for UN DESA’s Community of Ocean Action on Marine/Coastal Ecosystems. Marco is also former co-chair of the Global Commons Alliance.

Nicole Forrester

Chief Regenerative Officer at WWF-AustraliaNicole is the Chief Regenerative Officer (CRO) at WWF-Australia and leads the development and implementation of our strategy to Regenerate Nature by 2030. She is a proud Wiradjuri woman who has more than 20 years of diverse leadership experience. Nicole has proven experience in bringing about positive change by highlighting the Knowledge and Traditions of First Nations and the perspectives of local communities - in Australia and the Pacific region. Nicole’s experience spans government and international affairs and with a focus on innovation. Most recently before joining WWF-Australia, she served as the VP, Purpose, People and Culture at Fujitsu Asia-Pacific. As CRO, Nicole can pursue her passion for sustainability and regeneration and make a bigger difference in how communities adapt to global heating. She is excited create impact at the intersection of innovation, nature advocacy and community engagement.

Christine Holman

Non-Executive DirectorChristine is a Non-Executive Director with over 30 years’ experience across media, property, industrial, infrastructure and technology sectors.

She is on the Boards of two ASX companies, AGL Ltd and Collins Foods Ltd, one private company - Indara Pty Ltd, which is a joint venture between Australian Super and Singtel and two Not for Profit Boards, The State Library of NSW Foundation and The McGrath Foundation.

As a Director, Christine has worked on influencing greater engagement and action on ESG and decarbonisation, AI, Digitisation and Cyber Security, to embed the associated risks and opportunities in Corporate Strategy with a disciplined approach capital allocation, ensuring that organisations have a meaningful pathway to sustainable long-term returns.

In her previous executive capacity, as both CFO & Commercial Director of Telstra Broadcast Services, Christine brings a deep understanding of legacy and emerging technologies and digital transformations. During her time in private investment management, Christine assisted management and the Board of investee companies on strategy development, mergers & acquisitions, leading due diligence teams, managing large complex commercial negotiations, and developing growth opportunities.

Christine has an MBA and Post-Graduate Diploma in Management from Macquarie University and is a Graduate of the Australian Institute of Company Directors (AICD) and a member of the AICD Corporate Governance Committee.

Paul Clements-Hunt

Chief Executive Officer at The Blended Capital GroupPaul Clements-Hunt coined the acronym 'ESG' in May 2004 and as a United Nations official delivered the UN Principles for Responsible Investment (UN PRI) for Secretary General Kofi Annan in April 2006. PRI is now backed by 5400 institutional investors representing U$ 120 trillion in assets. Since 1991 Paul has operated globally and advised Prime Ministers, governments, corporate boards, capital markets, and civil society and community organisations on the mobilisation of finance at scale into critical sustainability challenges and opportunities. After heading UNEP-Finance Initiative for 12 years, Paul founded The Blended Capital Group (TBCG) in March 2012. Paul is a Board Member at Global Infrastructure Basel, and Chair of the Board at Future Fit Foundation.

Prof Timothy Lynch

Professor of US Politics at The University of MelbourneTim Lynch is Professor of American Politics at the University of Melbourne. One of Australia’s most read academic commentators, he is a regular contributor to The Australian newspaper.

His latest book, In the Shadow of the Cold War: American Foreign Policy from George Bush Sr. to Donald Trump (Cambridge, 2020), has been called ‘a cogent, graceful, provocative account’ of its subject.

In 2022-23, Tim was the Milward L. Simpson Visiting Fulbright Professor at the University of Wyoming, in America’s reddest state.

Tim long been a bridge between academia and public discourse, evident in his widely read op-eds and his leadership in community programs like Melbourne’s sell-out 10 Great Books Masterclass.

Twice a Fulbright scholar, Tim holds a PhD in political science from Boston College, Massachusetts.

Born and raised in the English midlands, Tim is a citizen of Australia and Great Britain. He lives in rural Victoria.

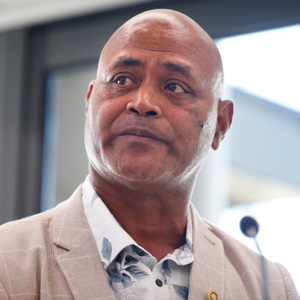

Moe Turaga

Modern Slavery Survivor AdvocateFor the last eight years, Moe Turaga has been telling his powerful personal story to advocate for responsible business practices towards people vulnerable to modern slavery.

Moe first shared his story at the parliamentary inquiry that led to Australia’s Modern Slavery Act. Since then, he has become a key voice for survivors in conversations about improving Australia’s modern slavery response. He speaks regularly to corporate governance audiences.

In 2023, Moe received a Freedom Award in recognition of his work.

In 2024, he received a commendation from the NSW Anti-slavery Commissioner.

He is a consultant to the Australian Catholic Anti-slavery Network (ACAN) and an Advisory Committee member to Domus 8.7 Remediation Service.

Moe is actively engaged with at-risk workers in horticulture, meat processing, hospitality and aged care including workers on the Pacific Australia Labour Mobility scheme.

Julia Lee

Head of Client Coverage, Pacific at FTSE RussellJulia Lee one of Australia’s best known financial experts providing commentary to Bloomberg, CNBC, ABC, BCC, Sunrise and on radio, podcast and in newspapers. She is currently the Head of Client Coverage – Pacific at FTSE Russell’s Index Investment Group and focuses on asset owners in Australia and New Zealand.

She is a seasoned financial professional with extensive experience in the equities and ETF markets. She has held key positions such as the ETF Equities Strategist Asia-Pacific Region at State Street Global Advisors, Chief Investment Officer at Burman Invest, and Equities Strategist at Bell Direct.

With over 20 years experience, Julia has demonstrated expertise in investment insights, financial product development and portfolio strategy, making her a frequent speaker at industry conferences and events.

Julia is on the board of directors for the Australian Stockbrokers Foundation. She has her Master of Business in Finance and is an accredited Derivatives Advisor (ADA2(ASX)).

Dr Huw McKay

Visiting Fellow at ANU and former Chief Economist of BHPDr Huw McKay is a Visiting Fellow in the Crawford School of Public Policy at the ANU, and Founder of Dark Matter Advisory, a boutique strategy and foresight firm. He is an economist and historian by training. His research is centred on the concept of the “quadrilemma” – the simultaneous pursuit of prosperity, populism, rivalry and the energy transformation. His advice and counsel are widely sought by multinational companies, governments, and the investment community, and he is a regular commentator on major issues in public policy, financial markets and the real economy.

Prior to his current roles, he spent eight years as Vice President of Market Analysis and Economics [Chief Economist] at BHP, the world’s largest mining company, based in Singapore. He has also practiced in finance, government, think tanks and academia, and served on the Chief Economists council of the World Economic Forum. Huw has an exceptional forecasting track record established

over 25 years of professional experience, spread across a broad range of themes and encapsulating time horizons from the very short term to as far out as 2100.

Huw’s expertise includes macroeconomics, geopolitics, financial markets, commodities, climate change, technology forecasting, and scenario analysis. Regionally, he is one of the world’s leading Asian experts, especially the three giants of China, Japan and India.

He is the author of The Strategic Logic of China’s Economy, published recently by Springer, and he is also the discover of the “Kuznets Curve for Steel”, which is a nonlinear relationship between economic development and steel demand per capita.

Huw has a PhD in Economics and History from the Australian National University and a Bachelor of Economics (1st Class, University Medal) from the University of Sydney.

John Moutsopoulos

Partner at Mills Oakley LawyersJohn is a leading investment fund and financial services specialist with over 20 years’ experience in top tier Australian and international law firms acting for private industry and government in relation to investment transactions across a range of real asset classes and venture capital.

Before joining Mills Oakley, John co-led the ESG portfolio for KPMG Law Australia for 5 years working closely with climate change, sustainability, and natural capital experts a combination and experience which has allowed him to make a difference with his clients as they lean into a net zero, nature positive future.

John is a cross border funds expert with a focus on real estate and new investment solutions in the ESG/low carbon space including across agri farmland, carbon and natural capital and biodiversity credit projects and markets. On a personal front John is also a regenerative sheep farmer.

Carmen Leung

Senior Manager, Sustainable Product, APAC at FTSE RussellCarmen is a highly respected and influential leader in the field of sustainable finance, spearheading the sustainable product development strategy for FTSE Russell across the APAC region. With more than 20 years of distinguished experience and deep expertise in ESG, climate, and sustainable investments, she has earned a reputation as a trusted authority in delivering impactful solutions that address the increasingly complex sustainability challenges faced by clients across Asia-Pacific.

Carmen's strategic vision and hands-on leadership have been integral to advancing industry-leading initiatives that align financial performance with sustainability outcomes. Prior to joining FTSE Russell, she played a transformative role at Pendal Group, where she led the product strategy and development, shaping the company's sustainability offerings and cementing its position as a pioneer in responsible investing.

Carmen’s unparalleled knowledge, coupled with her ability to translate cutting-edge insights into actionable solutions, has positioned her as a key driver of innovation in sustainable investment practices across the region and globally.

Carmen is a CFA Charterholder and holds a Master of Commerce (Finance) from the University of New South Wales. She is an independent member of the Responsible Investment Association Australasia (RIAA) Certification Assessment Panel.

Lisa Lautier

Partner at K&L GatesLisa is a partner in the Asset Management and Investment Funds practice area in Sydney. She has extensive experience advising on investment funds and financial services regulation.

Lisa is a trusted legal adviser who is passionate about providing practical advice with exceptional client service. She enjoys assisting local and offshore clients navigate the complexity of the Australian regulatory regime.

Lisa provides specialist advice on:

-fund formation across a range of asset classes including equities, fixed income, private credit, and direct property;

quotation and listing of exchange-traded funds (ETFs);

-promotion and disclosure obligations for managed investment schemes (registered and unregistered);

-outsourced trustee arrangements, fund operation, and service agreements related to investment management, custody, and administration;

transactional matters involving change of trustee or responsible entity; and

-financial services regulation in relation to Australian financial services licensing, design and distribution obligations, ESG regulation, ASIC relief, and breach reporting requirements

Samuel Jones

President at Heartland Initiative, Inc.Sam Jones is president and co-founder of Heartland Initiative, where he leads the development of methodologies, tools, and guidance to assist investors in the prevention and mitigation of human rights harms across their portfolios. Sam has over 25 years of experience in conflict-sensitive research, analysis, and programming, international humanitarian and human rights law, and multi-stakeholder engagement in public and private spheres. Before co-founding Heartland Initiative, Sam worked as Associate Director of the Human Rights Program at The Carter Center, where he managed programs in the Middle East and the Democratic Republic of the Congo, including those focused on corporate accountability for human rights harms in industrial mining and the protection of human rights defenders. Sam previously served as regional representative for Asia/Near East for Counterpart International, managing humanitarian and development programs in Iraq and Jordan and leading assessment missions to the Occupied Palestinian Territories, Lebanon, and Afghanistan. Sam holds a master’s degree in international peace and conflict resolution from American University’s School of International Service and a Bachelor of Arts in Political Science from the University of North Carolina – Asheville.

Adam Davids

Managing Director of First Nations Equity PartnersAdam Davids is the Managing Partner of First Nations Equity Partners where he engages investors and analyses ASX 200 companies regarding their practices and outcomes with Indigenous Australians.

He is a proud Aboriginal man and a descendant of the Wiradjuri people, Fulbright Scholar, and board member of Social Ventures Australia and CareerTrackers.

As one of the pioneers of CareerTrackers and CareerSeekers, Adam has forged partnerships with some of Australia’s leading employers to create thousands of career and educational opportunities with First Nations professionals, asylum seekers and refugees.

Through his Fulbright exchange he uncovered groundbreaking insights into global racial equity standards and the parallels with underserved minorities around the world. Over the years Adam has established a network of community leaders, leading academics, NGOs and business leaders to promote equity, justice and the self-determination of First Nations people.

Paul Oosting

Chief Growth Officer at AcaciaPaul Oosting's expertise is in strategy and communications that build engagement. He has worked as an advisor for the Pooled Fund on International Energy (PIE), Boundless Earth, Global Cooksafe Coalition, Climate Energy Finance and others. As National Director (CEO) of GetUp, Paul led the team to engage over 1.5 million people, and raise $67 million in donations.

Paul has spent the last 15+ years working in impact for justice, nature, and climate solutions. He now works with leaders and companies with a vision to scale change, and is Chief Growth Officer at Acacia.

Liza McDonald

Head of Responsible Investments at Aware SuperLiza McDonald, Head of Responsible Investments, Aware Super

Liza has over 20 years’ experience in the superannuation sector and is a specialist and passionate advocate for Responsible Investments and Sustainable Finance.

As Head of Responsible Investments , she has led the development and implementation of the Fund’s Responsible Investment policies, the execution of the Climate Change Strategy and also manages the ESG policy implementation including manager and asset class ESG reviews.

Liza joined Aware Super through our merger partner Health Super in December 2006 as an analyst in the Compliance, Legal and Risk Team. Before joining Aware Super, Liza held various roles at Mercer Legal where her primary focus was on trustee education and corporate secretarial duties.

Liza represents Aware Super on a number of working groups and committees including Investors Against Slavery & Trafficking APAC (IAST-APAC); ESG Research Australia; the Australian Sustainable Finance Initiative (ASFI); the Responsible Investment Association Australasia (RIAA); 40:40 Vision; the Australian Council of Superannuation Investors (ACSI) and the UN convened Global Investors for Sustainable Development Alliance (GISD).

Liza became a RIAA Board Member in December 2022.

Måns Carlsson OAM

Chair of RIAA's Human Rights Working Group and Head of ESG and Co-PM Active Sustainable at Ausbil Investment ManagementMåns leads Ausbil’s ESG team who take an active approach to engaging Australia’s listed companies on environment, social and governance issues. Måns also leads Ausbil’s integration of proprietary ESG scoring, research and ratings within Ausbil’s top-down bottom-up valuation approach. Måns has been with Ausbil since 2015. Prior to Ausbil, Måns held senior ESG positions at AMP Capital, and worked at Carnegie Investment Bank, Macquarie Bank and Accenture. Måns is well known for his advocacy, research and leadership on key ESG issues, including modern slavery, climate change, human rights, governance and stewardship, and many other ESG issues. In 2022, Måns was awarded an Order of Australia Medal (OAM) for contribution to the responsible investment industry. He has also received a letter of commendation from Anti-Slavery Australia in 2019. Måns also holds a number of leadership positions in the industry, including: Director of RIAA (Responsible Investment Association Australasia); Chair of RIAA’s Human Rights Working Group; and is on the steering committee of IAST-APAC (Investors Against Slavery and Trafficking – Asia Pacific). Måns holds Bachelor of Science (Major in Business Administration) and Master of Finance degrees from Gothenburg School of Economics, an MBA from Griffith University, and is graduate of the Australian Institute of Company Directors (AICD).

Rachel Alembakis

Stewardship Manager at U EthicalRachel Alembakis is stewardship manager at U Ethical Investors. In her role, she is responsible for managing U Ethical’s active ownership activities. She was previously the managing editor and founder of FS Sustainability, a Rainmaker title that examines how investors and companies integrate environmental, social and corporate governance issues into their decision-making processes and host of the ESG podcast The Greener Way. She has more than a decade's experience as a financial journalist covering a broad range of investment issues. Rachel holds an MSc in Politics of the World Economy from the London School of Economics and Political Science, a BA in journalism and a BS in political science from Boston University.

Moana Nottage

Senior ESG and Sustainability Analyst at Alphinity Investment ManagementMoana is an ESG and sustainability analyst at Alphinity Investment Management who contributes to active integration of Environmental, Social and Governance into the investment process. She conducts research and data analysis on typical ESG topics, and also considers the implications and opportunities of various sustainability issues related to the UN Sustainable Development Goals. Moana takes part in thematic research (e.g. modern slavery), product development, company engagement and monitors ongoing ESG risks with a focus on global stock and sector analysis.

Moana joined Alphinity in May 2020 as an intern to support the global team and in June 2021 moved into a full-time role working across domestic and global funds. She has an active role supporting the Sustainable Share Fund Compliance Committee and assists in the governance and research associated with the global and domestic sustainable strategies.

Moana has a Bachelor of Science and Commerce from the University of Sydney, with majors in Biology, Environmental Studies and Finance.

Pablo Berrutti

Senior Investment Specialist at Stewart InvestorsPablo is a senior investment specialist at Stewart Investors, a dedicated sustainable development focused, listed-equities manager. He is also the co-founder and managing director of Altiorem, a not-for-profit library and resource centre dedicated to supporting advocates for a sustainable financial system, and a member of the advisory committee to UNSW’s Human Rights Institute. Previously, Pablo was Head of Responsible Investment Asia Pacific at Colonial First State Global Asset Management (now First Sentier Investors) and Perpetual Limited. Pablo served as a director of the Responsible Investment Association of Australasia for ten years and was chair for six. Pablo has also served on the management committee of the Investor Group on Climate Change and the coordinating working group of the Australian Sustainable Finance Initiative, among other industry initiatives.

Kate Turner

Global Head of Responsible Investment at First Sentier InvestorsKate Turner is Global Head of Responsible Investment at First Sentier Investors. Based in Sydney, Kate and her team are responsible for defining and delivering our strategy globally. This includes supporting investment teams to integrate ESG factors into their investment processes, engaging with clients and stakeholders on responsible investment and creating learning and development opportunities for staff across all levels of the firm.

Kate holds a number of additional roles, including Board Member of the Responsible Investment Association of Australasia, Chair of Investors Against Slavery and Trafficking APAC and Advisory Group member of the Net Zero Asset Managers Initiative.

Prior to joining First Sentier Investors, Kate was an Associate Director at Sustainalytics leading its business in Australia and New Zealand, and has previously held roles at ICBC Standard Bank Plc in London and Baker & McKenzie in Sydney.

Kate holds Bachelor of Laws degree and Bachelor of Arts degree in International Studies with First Class Honors and University Medal from the University of Technology, Sydney.

Kate reports to the Global Head of Investment Management.

Arti Prasad

Partner, Sustainable Investments at MercerArti Prasad is currently Partner, Sustainable Investments at Mercer. She is responsible for leading sustainable investment practices with clients across the Pacific. Before this role, she worked as a Senior Investment Strategist for the Guardians of NZ Superannuation, a Crown entity that manages the New Zealand Superannuation Fund. During her time at the Guardians from 2017, Arti was responsible for developing and implementing policies related to Responsible Investment, climate change, and corporate governance. Prior to this, Arti worked as the Head of Responsible Investment for the Queensland Investment Corporation (QIC) for two years. She also served as a Senior ESG Analyst for the Guardians and a Senior Policy Analyst at the NZ Ministry for Environment, where she worked on policies related to business sustainability, water, and climate change.

In 2014 Arti was named one of Chief Investment Officer magazine’s ’Top 40 under 40’ in the asset allocation world.

Gordon Noble

Research Director of UTS Institute for Sustainable FuturesGordon is a Research Director with the Institute for Sustainable Futures at the University of Technology Sydney (UTS) focusing on sustainable finance. Gordon has worked across financial systems in a variety of capacities over a thirty-year career including in frontline roles in banking, superannuation, and investment management, as a political advisor, in industrial roles representing finance sector workers and in policy / research roles with industry associations and universities.

Gordon was one of the first employees of the United Nations backed Principles for Responsible Investment, founded what is now the PRI Academy and in 2020 co-authored the Australian Sustainable Finance Roadmap released by the Australian Sustainable Finance Initiative.

Freya Dinshaw

Associate Legal Director of Human Rights Law CentreFreya Dinshaw is an Associate Legal Director at the Human Rights Law Centre, and has over a decade of experience specialising in business and human rights. Freya’s work focuses on exploring opportunities for deploying advocacy, strategic litigation and international mechanisms to challenge the treatment of marginalised communities by governments and companies. Recent examples include co-authoring the Paper Promises and Broken Promises reports on the Australian Modern Slavery Act, supporting Bougainville communities in a human rights complaint through the OECD National Contact Point, and Supreme Court litigation in relation to an asylum seeker’s death in offshore detention. Prior to joining the HRLC, Freya was a Senior Associate at Allens Linklaters, and she previously worked at the British Institute of International and Comparative Law. She is an honorary research fellow in modern slavery and regular guest lecturer at Melbourne Law School, and serves on the Australian OECD National Contact Point Advisory Board and steering committee of the Australian Corporate Accountability Network.

Rhiannon Young

Associate, Renewables at Clean Energy Finance CorporationRhiannon Young is an Associate in the Investment team at the Clean Energy Finance Corporation, focusing on large-scale renewables. Rhiannon works across deal origination, structuring, and execution to optimise both commercial and sustainable outcomes. Rhiannon has experience across direct equity, debt capital markets and project finance transactions in various sectors including renewables, natural capital, and consumer finance. Rhiannon is a Chartered Accountant and holds a Bachelor of Finance (major in Quantitative Finance) and a Bachelor of Accounting from the Australian National University.

Kristina Hermanson

Head of APAC & Africa at Nuveen Natural CapitalKristina Hermanson is the Head of APAC and Africa at Nuveen Natural Capital. She targets growth in the region in farmland, timber and nature-based investments in collaboration with the expertise across Nuveen. The Australian Farmland core business is a key component within the APAC region with growth potential into nature-based solutions with regenerative agriculture at the core.

With proud roots on a dairy farm in Wisconsin, Kristina has more than 25 years of international leadership experience, most recently serving as Managing Director of ANZ & ASEAN at FMC Corporation. Kristina started her career as a mechanical engineer based in Europe and worked in commercial, strategy, and M&A roles in EMEA and APAC over a decade with global agribusiness firm, Archer Daniels Midland. She also served as Director of Growth and Collaboration, at Coca Cola Amatil in Australia before joining FMC. Kristina is a Non-Executive Board member at the Australian Farm Institute and has recently served as a Director of AgSafe, CropLife Australia, and non-profit, Business for Development.

Will Leak

Co-Chair of RIAA's First Nations Peoples' Rights Working Group & Senior Sustainable Investment Analyst at MercerWill Leak is a Senior Associate in Mercer’s Investments business, based in Sydney. As part of the investment management team, his role as Senior Sustainable Investment Analyst sees him focused on integrating environmental, social and governance (ESG) considerations within the investment process, including selecting and monitoring investment managers, a range of stewardship activities, plus analysis and implementation related to exclusions and thematic topics like climate change.

Will has a passion for the intersection of First Nations Peoples and traditional investment markets is involved in a number of First Nations industry bodies, including as Co-Chair for the Responsible Investment Association Australasia's (RIAA) First Nations Peoples' Rights Working Group and a member of the Reconciliation Action Plan Taskforce plus the Australian Sustainable Finance Institute’s First Nations Reference Group.

Estelle Parker

Co-CEO of RIAAEstelle Parker leads RIAA’s research, certification, policy, standards and working group programs. She brings 20 years’ experience leading strategic initiatives as a diplomat, policy analyst, stakeholder manager and strategic planner with the Department of Foreign Affairs and Trade (DFAT). Estelle served, inter alia, as Acting Ambassador and Deputy Ambassador to Mexico, Central America and Cuba; Deputy State Director (Victoria); Policy Adviser to the Regional Assistance Mission to Solomon Islands; and as Director overseeing the development and management of bilateral relationships.

Estelle also worked for five years at the University of Melbourne, where she lectured in the Master of Public Policy and Management and Master of International Relations, and has experience on boards and committees. She is currently a member of the Principles for Responsible Investment’s Global Policy Reference Group and the Australian Government’s Natural Capital Working Group, as well as Convenor of the Taskforce on Nature-Related Financial Disclosures official Consultation Group for Australia and Aotearoa New Zealand.

Estelle holds a Master of Public Policy and Management (First Class Honours), Master of Communications (With Distinction), Bachelor of Arts (av. First Class Honours) and Certificate in Business Sustainability Strategy.

Dean Hegarty

Co-CEO of RIAA and Governance Committee Member, Stewardship Code Aotearoa NZDean collaborates closely with global and local asset managers, super funds, Kiwisaver providers, financial advisors, and wealth platforms to align capital with sustainable outcomes. His strategic leadership has played a pivotal role in elevating RIAA's presence in both Australia and Aotearoa New Zealand. With over a decade of experience leading teams in the not-for-profit sector, Dean also serves as a member of the National Advisory Board on Impact Investing in New Zealand and sits on the GovCo of the New Zealand Stewardship Code.

Shalini Samuel

Head of Certification at RIAAShalini plays a pivotal role at RIAA, spearheading the oversight of the organisation’s esteemed Certification Program, Sustainability Classifications, and related projects. Shalini’s role is vital as the financial industry faces increased scrutiny and a need for accurate product labeling. Her dedication ensures RIAA’s Certification Program remains robust and trustworthy in an ever-evolving market landscape.

With 10 years of experience in ESG investment and certification, her expertise strengthens RIAA’s position. She has contributed significantly to the responsible investment and broader sustainability industry through organisations like B Lab Australia and Aotearoa New Zealand, Minderoo Foundation, and the UN-backed Principles for Responsible Investment. With a wealth of expertise, Shalini brings valuable insights from her extensive background, benefiting RIAA and its mission as a whole.

Nayanisha Samarakoon

Head of Policy & Advocacy at RIAANayanisha is a senior lawyer with extensive federal public sector experience in governance, corporate compliance and regulation.

She arrives at RIAA after a long history at the corporate regulator, the Australian Securities and Investments Commission (ASIC). She was the project lead on ASIC’s thematic review into greenwashing by ‘green’ or ‘ethical’ managed funds and superannuation funds. This consisted of a review of the market, close engagement with international regulators and International Organization of Securities Commissions (IOSCO), and developing a deep understanding of both the existing Australian regulatory framework and government priorities as well as international development in this space. Through this review, she led a group across ASIC’s Corporations, Superannuation and Investment Managers teams to deliver industry and consumer guidance.

Outside of work, she volunteers as a board member and secretary at Juno Services Inc., a not-for-profit family violence and homelessness service provider based in Melbourne. She is also on the board of Fitted for Work, a charity focused on helping women experiencing disadvantage get work, keep work and navigate through working life.

Brendan Bailey

Head of Operations at RIAABrendan leads RIAA’s internal operations, with oversight over the structures, systems and processes that ensure the smooth running of the organisation.

Prior to joining RIAA, Brendan led the operations of the Education and Safeguarding Services team at the Australian Childhood Foundation (ACF), building on extensive experience as a trauma-responsive education consultant and manager at ACF, Sexual Health Victoria and Berry Street.

Brendan brings to this role a passion for systems-informed organisational psychology and the potential for organisations such as RIAA to create transformational change. He holds a Masters in Applied Positive Psychology, a Graduate Diploma in Secondary Education, and a Bachelor of Arts.

Anson Chan

Senior Responsible Investment Analyst at RIAAAnson leads the implementation of the Responsible Investment Standard and Guidance Notes through assessments of financial products. In addition to conducting assessments, Anson contributes to ensuring that Guidance Notes stay refined, up-to-date and fit for purpose through his engagement with RIAA members. Currently, he manages product claims checks within the Certification Program and is responsible for analyst mentorship and management of the Certification Administration Officer.

Anson holds a Master of Arts (major in mathematics), Certificate in ESG Investing (CFA UK) and is a Charted Financial Analyst (CFA). Prior to joining RIAA he was an experienced equity research analyst focusing on emerging markets, and has published equity research as well as ESG thematic reports.

Marco Lenfers CFA

Client Portfolio Manager - Executive Director of Vontobel Asset ManagementMarco Lenfers joined Vontobel in 2016. He is Client Portfolio Manager with responsibilities for impact strategies within the Impact & Thematic team at Vontobel Conviction Equities.

Prior to joining Vontobel, he held similar roles at Notenstein La Roche Privatbank AG and Vescore AG (integrated in Vontobel in 2016) since 2013. From 2010, he was Head of Client Portfolio Management at Bank J. Safra Sarasin AG in Basel. From 2000, he was a senior portfolio manager at HSBC Global Asset Management (Deutschland) GmbH in Düsseldorf.

Marco holds a diploma in Business Economics (Diplom-Kaufmann) from the University of Münster. He is also a CFA® charterholder.

Caleb Adams

Director, ESG & Sustainable Investment of E&P Financial GroupCaleb Adams is a proud Wulli Wulli man and a Director within the Evans & Partners (E&P) ESG & Sustainable Investment team, with over 10-years experience across impact investment, sustainability strategy and First Nations affairs.

Founded in 2007, Evans & Partners is one of Australia's largest wealth management firms, supporting over $30B in client Funds Under Advice. E&P also provides financial services across funds management, corporate advisory, and institutional sales and trading.

Caleb contributed to the 2024 UN DESA Expert Group Meeting (EGM) on 'Indigenous Peoples in a Green Economy', co-authoring a report of recommendations to the 2024 United Nations Permanent Forum on Indigenous Issues (UNPFII). He is a Non-Executive Director of Climate Action Network Australia (CANA), and sits on several advisory committees, including the Australian Sustainable Finance Institute (ASFI), the Responsible Investment Association of Australasia (RIAA), NEXUS Australia, Philanthropy Australia and Ormond College.

Caleb holds a Master of Development Studies, a bachelor of Environmental Engineering and is a Graduate of the Australian Institute of Company Directors.

Julia Leske

Managing Director, Senior Consultant ESG Strategy of ISS ESGJulia has over 15 years’ experience working in the ESG industry. In her role as Senior Consultant ESG Strategy at ISS ESG, Julia works with key stakeholders in the Responsible Investment industry on ESG strategy and implementation. Through working with a broad range of investors to incorporate ESG criteria into their investment processes, participation in multi‐stakeholder groups and investor collaborations, Julia has extensive experience in stakeholder engagement, company sustainability assessments, ESG data and reporting frameworks. Prior to joining ISS STOXX, Julia was CEO of the Australian ESG research house CAER (now part of ISS ESG).

Linda Romanovska

Partner, Head of Sustainability Consulting at MaterraLinda is a senior advisor on sustainability, with close to two decades of experience delivering high-impact work on a wide range of sustainability topics. She has undertaken policy-making, research and consulting for a broad range of entities in the public and private sectors. Linda brings deep expertise across all facets of ESG, with a particular focus on local and international sustainable finance and corporate sustainability reporting frameworks/standards such as the ASRS/AASB, ISSB/IFRS, CSRD, EU (and other) taxonomies, SFDR, GRI, SASB, TCFD, TNFD, PRI and many others.

Early in her career Linda worked within the European Commission drafting the inaugural European Union’s climate change policies and worked closely with the European Environment Agency and international supranational organisations. Her extensive expertise is recognised in her current high-level appointments supporting the drafting of sustainability regulations and standards for Australia, the European Union, ASEAN and beyond, including Australia, European and other sustainable finance Taxonomies, EU CSRD, SFDR, Green Bond Standard, TNFD, ISO standards on sustainable finance, ACT Methodology on Mitigation and Adaptation to climate change maturity assessments as well as a suite of Adaptation Planning guidance and support tools. She is also known for her work on natural capital, socially just transitions and many other sustainability topics.

Linda has led the ESG reporting compliance and voluntary sustainability work for a number of large and small public and private entities operating locally or internationally across several markets and jurisdictions.

Alison George

Chief Impact & Ethics Officer at Australian Ethical InvestmentA mission-driven senior professional Alison has nearly 20 years’ experience in responsible investment and stewardship, working with numerous industry leaders in her prior roles with Pendal and Regnan.

Alison is a board member at the Institute for Energy Economics and Financial Analysis (IEEFA) Australia and Chief Impact & Ethics Officer for Australian Ethical Investments, where she implements AEI’s Ethical Charter into its investments, corporate activities and Foundation giving to grow positive outcomes for people, planet and animals.

Paul Kearney

CEO and Founder of Kearney GroupPaul Kearney is the founder and CEO of the award-winning Kearney Group, which has been providing holistic financial services since 1986. Paul holds a Bachelor of Commerce from the University of Melbourne, and is a Certified Financial Planner, Certified Practicing Accountant and a member of the Financial Planning Association of Australia and the Association of Financial Advisers.

Under his leadership, Kearney Group has been widely recognised for its commitment to professional excellence, client service and innovation. Most notable are the firm’s national accolades, which include being named the Association of Financial Advisers’ Australian Practice of the Year in 2016 and BT Financial’s two-time National Practice of the Year.

Paul was named Adviser of the Year in 2010 and the Financial Planning Association’s Best Practice Awards runner-up in 2013. Paul was Victorian Representative and later, inaugural National Chair of Securitor Financial Group’s Professional Advisers Council from 2012-2018. He was also a founding member of BT's Chief Executives Forum. He is a Director of renowned social enterprises, The Big Issue and Homes for Homes.

Emma Herd

Partner at EY AustraliaEmma is a Partner with EY’s Climate Change and Sustainability team and is a skilled professional with over 20 years’ experience in climate change, sustainable finance and sustainability practice. Prior to joining EY, Emma was Chief Executive Officer of the Investor Group on Climate Change (IGCC) (2015-2021) and Environment Commissioner for the Greater Sydney Commission (2020-2021). Previously, Emma worked at Westpac for over 15 years across a range of sustainability, environment, sustainable finance, climate change, carbon trading and ESG risk management roles. Emma is a regular media contributor on climate change matters and a respected voice on climate transition implications for business.

Nicolette Boele

Community Independent for BradfieldNicolette Boele is a responsible investment and clean energy executive with more than 25 years' experience in capital markets, sustainability, and climate change policy.

Nicolette's professional interest lies in building purpose into finance, growing just, social, and equitable capitals to underpin resilient and sustainable economies.

She has held executive roles at the Responsible Investment Association Australasia, The Climate Institute, and the Clean Energy Finance Corporation. She has also worked to better climate outcomes at the Australian Conservation Foundation, Investor Group on Climate Change, and the Sustainable Energy Development Authority.

She is a Non-executive Director at The Good Car Company and is a member of the Climate Impact Advisory Committee for New Zealand’s Climate Venture Capital Fund.

Nicolette was Bradfield’s community independent candidate in the 2022 federal election which enjoyed the largest swing in primary votes against a sitting member, anywhere in the country. Keen to demonstrate what true representation can be like, she has declared she will stand again for election in 2025.

Guy Williams

Co-Chair of RIAA's Nature Working Group and Director at Ziranjiti Pty LimitedGuy brings over 20 years’ experience at the leading edge of industry innovation and strategy in biodiversity and natural capital. Guy has held global roles at some of the largest consulting and advisory firms, as well as being an integral part in the development of many nature-related frameworks and standards such as the TNFD and SBTN. Guy possesses a deep interest in primate conservation, and the use of digital media and community-led storytelling to support effective conservation strategies.

Eveline Moos

Chief People & Culture Officer at Australian Ethical InvestmentEveline is responsible for people and culture strategy and execution at Australian Ethical, aligning talent to AE’s purpose, business strategy and client outcomes.

Eveline has extensive experience encompassing strategic and operational leadership within Financial Services. She holds a Bachelor of Commerce from Western Sydney University.

James Alexander

Senior ESG Manager at Sustainable Investment ExchangeJames is responsible for identifying environmental and social issues at ASX companies and working with institutional investors to support SIX's proposals to address them. He also works with the media and NGO partners to amplify SIX's campaigns. Prior to this, James worked at Future Super for 5 years helping create and implement ethical equity and fixed interest products, including through ethical screening, voting and engagement, and client relations.

Thalia Dardamanis

General Counsel at UniSuper ManagementThalia Dardamanis is the General Counsel for UniSuper, one of Australia’s largest superannuation funds and institutional investors with approximately $139 billion in funds under management. She leads the Legal team to provide legal support to the Fund’s superannuation, financial advice, administration and investment services businesses.

Thalia has been practicing in the superannuation industry for 20 years. Her prior experience includes being the Head of Legal Advisory at UniSuper, a Special Counsel in the M&A Funds team at Baker McKenzie and a partner in a boutique city law firm that practised exclusively in superannuation, taxation and succession laws.

She is a Chartered Tax Adviser and a Specialist SMSF Advisor™. She is a committee member of The Tax Institute of Australia’s National Superannuation Technical Committee and, for several years, lectured the superannuation module of the Advanced Chartered Tax Advisers program for The Tax Institute.

Thalia holds a Master of Laws (focusing on superannuation) from the University of Melbourne. She also holds a Bachelor of Laws and a Bachelor of Commerce (focusing on management and statistics) from Monash University.

Thalia is a regular presenter of superannuation, financial services and succession topics and has written extensively in these areas.

Jessie Pettigrew

Head of Responsible Investment at Equip SuperResponsible for the delivery of the responsible investment strategy at Equip Super, Jessie’s focus is on the integration of Environmental, Social and Governance (ESG) considerations into the team’s investment process, the asset stewardship program, including company engagement and proxy voting activities as well as sustainable investment advocacy. Jessie has worked in sustainability and ESG risk across financial services for almost a decade, with a focus on investments and superannuation.

Andy Symington

Director, Human Rights and Social Impact of KPMG AustraliaAndy is a human rights and social impact specialist with a particular focus on the energy transition. He leads KPMG Australia’s work on social impact, social performance and social value, KPMG’s global Just Transition response and its participation in the Alliance for a Just Energy Transformation with the UNDP, WWF and other key stakeholders. Andy works with clients on the social dimensions of corporate sustainability, especially relating to the just transition, a core theme of his PhD research. He was a lead author on KPMG & RIAA’s landmark Human Rights and Climate Change report, which highlights the importance that investors consider environmental and social risks more holistically. He teaches and writes extensively on the subject.

Terina Williams

Senior Investment Strategist at NZ Super FundTerina is a Senior Investment Strategist in the Sustainable Investments Team at the Guardians of New Zealand Superannuation (Guardians).

Prior to joining the Guardians, Terina held positions as a Policy Director on Climate Change for the Federation of Māori Authorities Inc., and as an advisor on national-level climate change strategies and policy design, related to the transport and agriculture sectors.

Terina’s career has focused on environmental and natural resource consultancy with a strong indigenous lens, which saw the implementation of treaty settlement mechanisms, Waikato River restoration initiatives, provision of strategy for whenua Māori, and supporting the realisation of Te Ao Māori.

Terina holds a Masters of Management Studies (First Class Honours), Majoring in Economics specialising in natural resource economics, and a conjoint Bachelor of Science, majoring in Biological Science and a Bachelor of Management Studies (First Class Honours).